DeFi and Dapps are gaining tractions more than ever. DeFi is the term used in Ethereum blockchain to achieve decentralized financiel services in the underlying distributed ledger.

With the characteristics of blockchain in nature, DeFi services are defined as decentralized without any institutions, publish transparent transactions and codes, and globally applicable in Ethereum blockchain.

Here’s a great writing by the coinbase blog about DeFi. It’s a must read.

A Beginner’s Guide to Decentralized Finance (DeFi)

You must have some ether, stablecoins or tokens in your wallet to do arbitrage in advance. I usually buy bitcoin over fiat, then exchange it to altcoin or stablecoins in crypto currency exchange.

What is Flashloan?

I think you might have the understanding what a normal loan is already. A normal loan means you a borrower can take out either money or asset, property whatever that is expected to be paid back with interest to lender in the future.

Flash Loans are special uncollateralised loans that allow the borrowing of an asset, as long as the borrowed amount (and a fee) is returned before the end of the transaction in blockchain. This implies that you don’t need collateralization or interest to borrow money in DeFi but only some fees plus transaction costs only.

There are various protocols providing Flashloan such as dYdX, Aave and Uniswap. Flashloan might open a door for everybody to borrow massive amount of money in crypto world and brought craze. As long as the liquidity pool allows to lend and that amout is available in the pool, people can borrow unlimited money.

There are some use cases with Flashloan.

- Arbitrage between assets or exchanges without needing the initial amount of investment

- Swapping collateral of loan positions, without having to repay the debt of the loan position

- Liquidation of debt in protocol without needing the principal amount

People got intrigued with Flashloan to execute their arbitrage strategy for profits and some people made it actually happened but there was a barrier for beginners to join this arbitrage party because of programming skill (solidity programming language actually). Implementations of smart contracts were required to perform such transactions for most of cases.

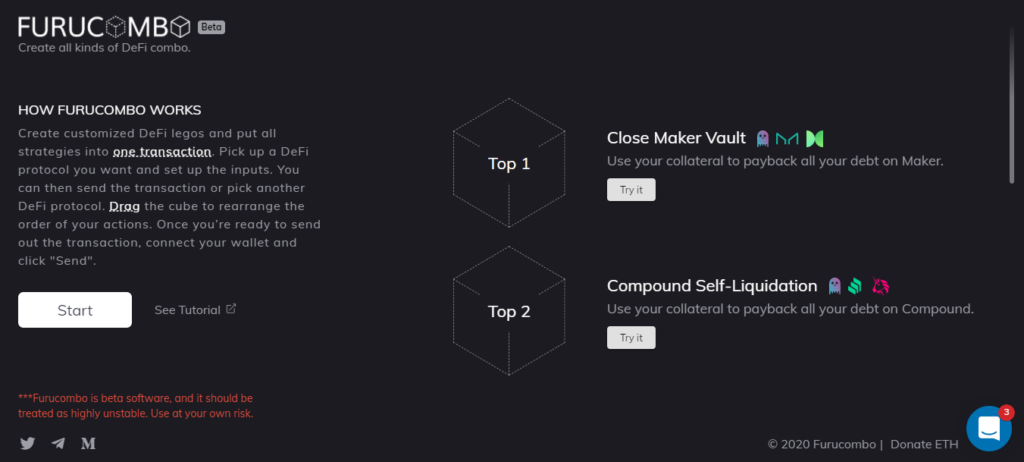

I’d like to introduce Furucombo app that is a tool to build your own DeFi legos for your strategy including arbitrage without needing any codes on simple web UI. You can check a look and feel from below link.

How to use Furucombo for Flashloan?

You’ll be able to create your DeFi combo (a bunch of transactions across various protocols) by just drag and drop on web UI. A combo consists of cubes and the orders how cubes should be executed in an order. A cube mean an action that will be taken such as swap eth to DAI in Uniswap or launch new Vault in MakerDAO, etc. You need to define each cube and change the order of cubes to complete your combo then execute a single transaction in Furucombo by 1 click.

Here’s the tutorial provided by Furucombo officially. I’ll introduce 1 successful combo later in this article.

Beginner’s Guide to Use FURUCOMBO

Let’s look through an example for Flashloan of Aave. On the top page of Furucombo and you can find some examples at right pane. Please click Start button to start your combo at left middle.

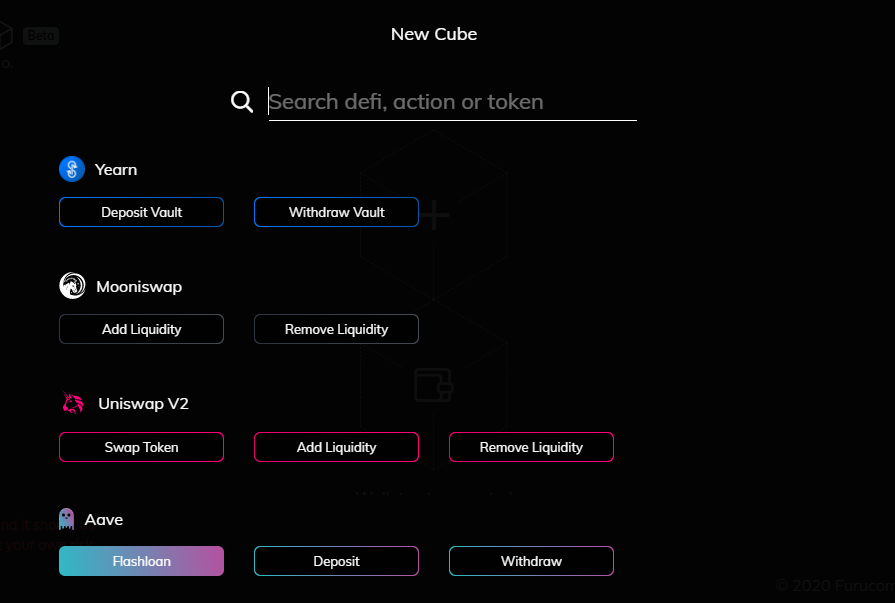

Click the “+” cube and select Aave “Flashloan” in the cube menu to start a Flashloan. This will set up a Flashloan for Aave liquidity pool.

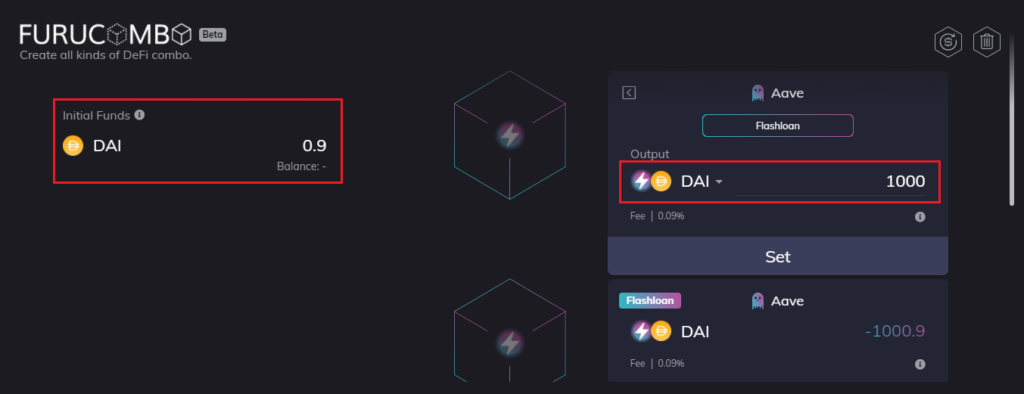

Next, you can set up a cube. In this case you need to configure what asset you will borrow and how many tokens you borrow. I set 1000 DAI in the following sample.

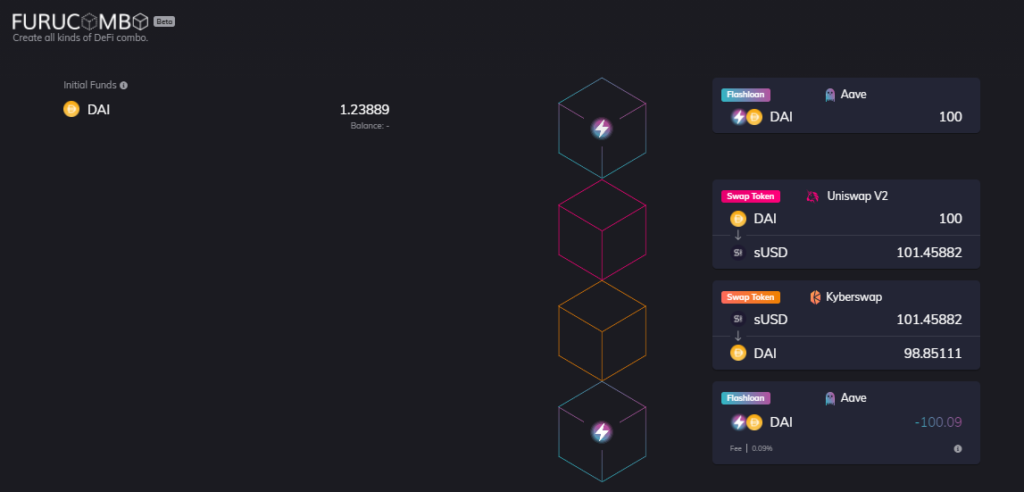

Aave Flashloan requires 0.09% fee for your loan. Flashloans are uncollateralised and not needing any interests but Aave takes a little fees instead of taking interest. In Furucombo you need to prepare and have this fee in your wallet initially not when you have executed all actions in a single transaction successfully.

If you borrow 1000 DAI you need 0.9 DAI for Flashloan fee in your wallet before executing a transaction. Initial funds at left top means the funds that you must provide at the beginning of the combo to initiate the transaction.

You will continue creating cubes by clicking + button and change the order one by one. Reimbursing funds need to move at the bottom for Aave Flashloan manually. The following image is the example that was introduced in Furucombo blog. Unfortunately this combo is no longer profitable but a similar strategy must work with different combinations.

Tutorial: Create Flashloan Combo on Furucombo

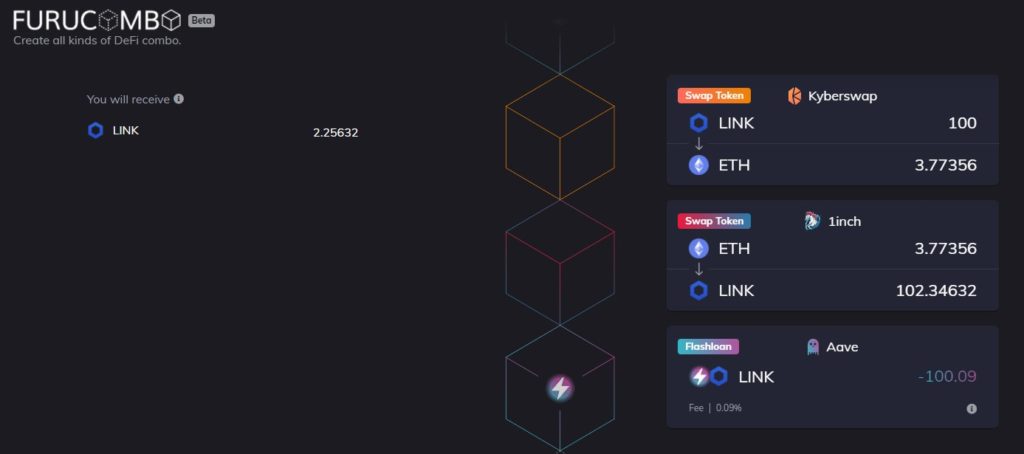

This is my own combo that worked fine to make a little profit. It’s just 2.25632 LINK that was about $30 when I executed.

- Borrow 100 LINK in Aave Flashloan

- Swap LINK with ETH in Kyberswap

- Swap ETH with LINK in 1inch exchange

- Reimburse 100.09 LINK to the liquidation pool

- Receive 2.25632 LINK as a profit

0.09 LINK is Flashloan fee you have to leave in Aave protocol.

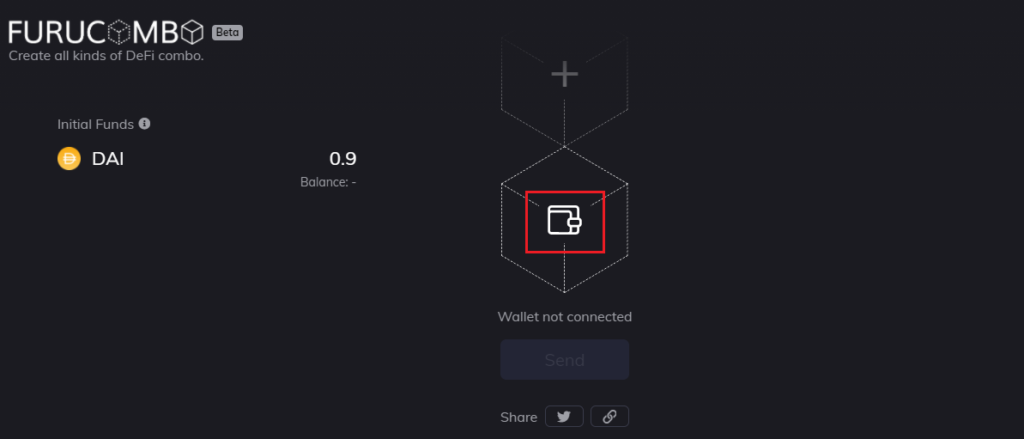

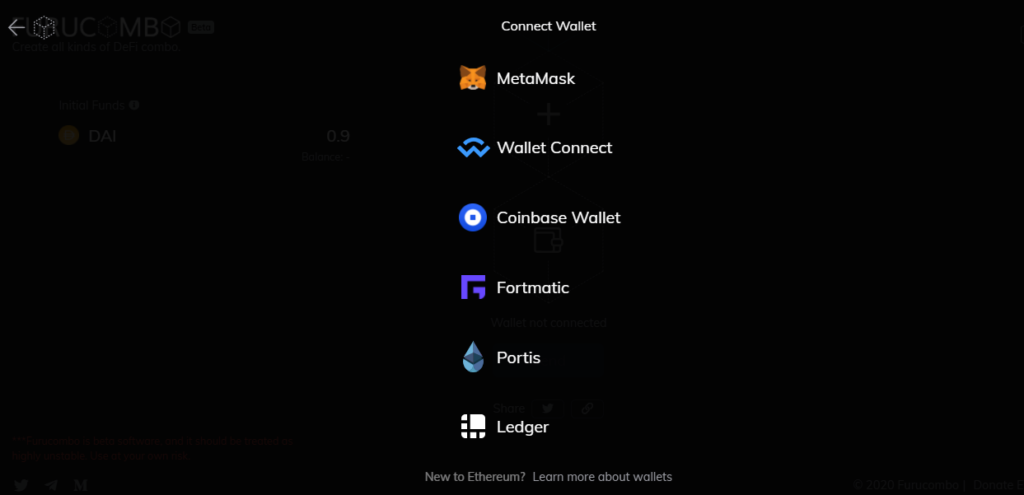

Once you’ve formed your combo and you’re ready, now you need to connect your wallet with the app and run a transaction. Please click the wallet mark then select your wallet such as MetaMask or Ledger, etc. There are multiple wallet supported for Furucombo.

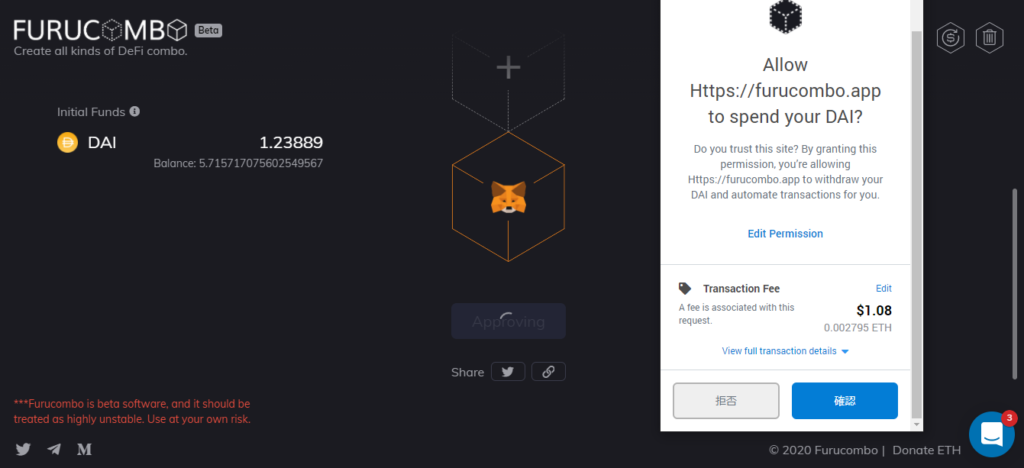

Finally you can fire your transaction if you afford gas fee by clicking APPROVE at the bottom of your combo. Please be careful of approving transactions. There might be two transactions to run your combo as below.

Also please note that if you’ve got a huge chain of transactions (means a big combo), that means your combo would cause the high transaction fees due to transactions will be executed in the underlying smart contracts in each protocol.

- Approving Furucombo contract to spend your token (DAI, etc)

- Approving a single transaction of wrapped cubes in Furucombo

Attentions

Gas fees are quite expensive recently and layer 2 solution needs to be adopted to ease this high transaction fee (The community seems to be working so hard to achieve ETH2.0 however it may take tima more than they thought). When you send out a transaction of arbitrage or whatever please confirm your transaction makes sense with paying that expensive transaction fee. There is no obvious indications of arbitrage opportunities with this app. So you need to find trading opportunities or generate opportunities intentionally by yourself if you make it profitable enough.

One thought on “How to create a Flashloan transaction without coding?”